I’m sure you’ve heard of the statement about saving money for a “rainy day”. Your finances are yours and it is your backup for life. So, be it investing money, tracking your spending and savings, including building a fund for emergencies, it is all of utmost importance!

Well, budgeting is easy and not as difficult as you think it might be. All you need to keep in mind are some simple finance rules that can help you save more money.

So, want to know what these rules are about? Find out below!

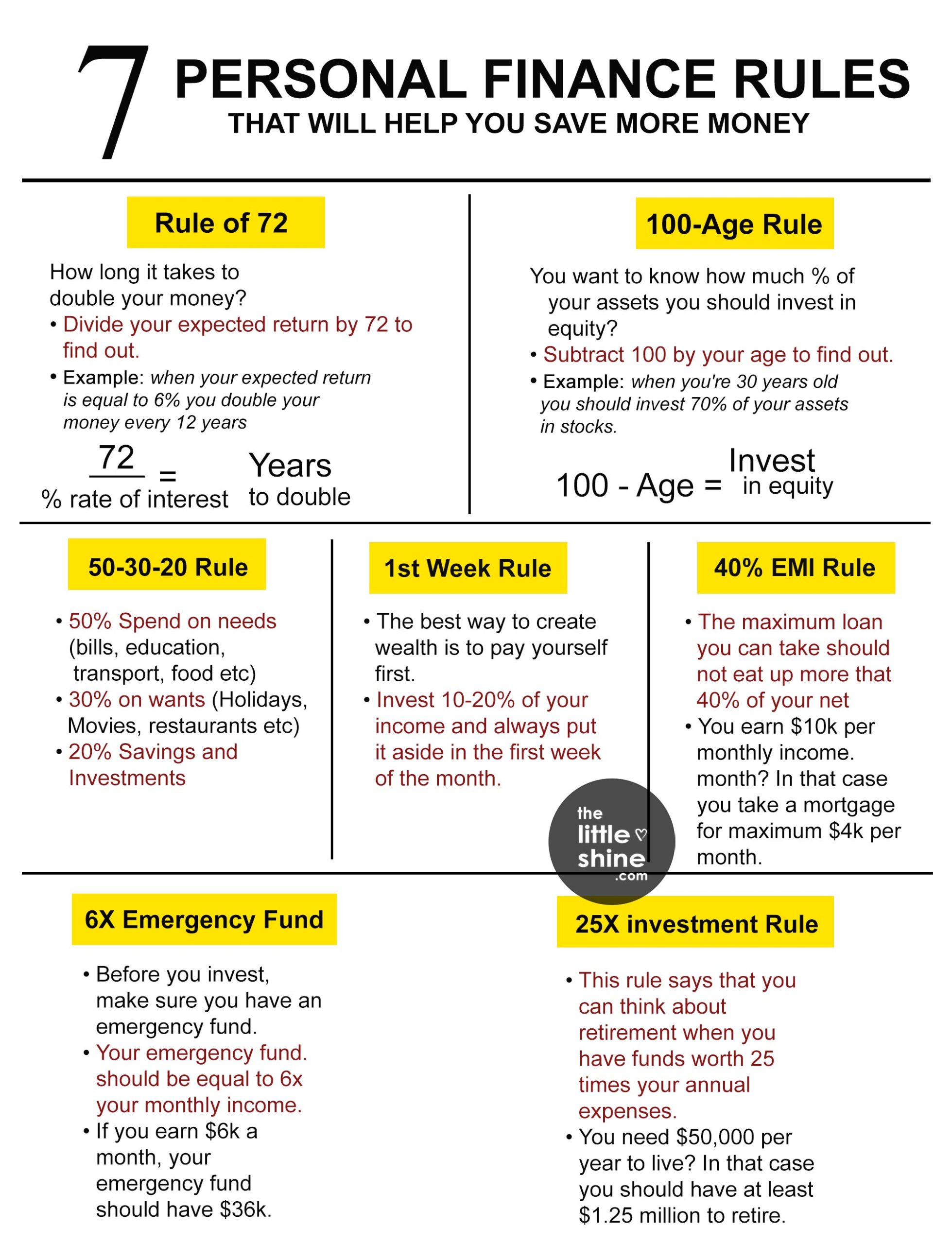

7 Personal Finance Rules to Save More Money

1. 25X Investment Rule

This rule talks about when you can think about “retirement”. According to this rule, you can think about retirement when you have 25 times more funds, than your annual expenses.

Start by estimating your annual living expenses in retirement, considering factors like housing, healthcare, travel, and leisure. Multiply your estimated annual expenses by 25 to determine your retirement savings target.

For example- if you need about $50,000 for a year to live, then you should have [50000*25] = $1.25 million in order to retire.

For example, if you are 60 years old and the 25x rule tells you that you need to save $1 million for retirement and you have only $800,000 saved, you know that you need to continue working and saving until you have saved an additional $200,000.

2. 40% EMI Rule

As per this rule; to take a loan, the maximum you should take is 40% of your net monthly income and nothing more than that. This simple rule ensures that your liabilities are in control and don’t disrupt your finances or ability to repay your loan.

For example- if you earn $10K per month, you can take a loan or a mortgage of a maximum of $4K per month and not more.

3. 50-30-20 Rule

This rule talks about how to budget your income. Here are 3 tips –

Tip 1: Spend 50% on needs like food, transport, education, bills etc.

Tip 2: Spend 30% on wants like movies, restaurants, holidays etc.

Tip 3: Make sure you save 20% for investments or general savings.

4. 6X Emergency Fund

Life is uncertain, as it can bring unexpected or unplanned financial emergencies or even job loss. As per the 6X Emergency Fund rule, before you make any investments, make sure you have an “emergency fund” ready. Start building an emergency fund immediately if you don’t have one. Your emergency fund should be equal to at least 6X of your monthly income.

Example – If you earn $6K a month, then your emergency fund should have at least $36K.

5. 1st Week Rule

As per this rule, the best way you can crate yourself wealth is by paying yourself first. This means that you need to invest a minimum 10% to 20% of your income and make sure to always put aside the amount within the first week of the month.

6. 100- Age Rule

Do you want to know how much percentage of your assets you need to invest in equity? Well, you can subtract 100 by your age and then find out.

So for example, you’re 40 years old, so 100 – 40 = 60% (of your assets need to be invested in equity).

The formula = 100 – Age = % of your assets need to be invested in equity

7. Rule of 72

The Rule of 72 is a simplified formula that calculates how long it’ll take for an investment to double in value, based on its rate of return. Here’s how you can get to know. All you need to do is divide the return you’re expecting by 72 and you can find out.

The formula is 72/ % rate of interest = Number of years to double.

For example – If your expected return is 6%, you will double your money every 12 years. 72/6 = 12

If your interest rate changes or you need more money because of inflation or other factors, use the results from the Rule of 72 to help you decide how to keep investing over time. The Rule of 72 is an important guideline when considering how much to invest.